Original Indicators Suite

A growing pack of invite-only TradingView tools powered by proprietary engines (CLM, SAND, PD, VDE and more) — designed for clean decision-making, not indicator clutter.

Purchase, submit your TradingView username, and you’ll be added to the invite-only list.

1) Purchase

Buy via originalindicators.com.

2) Submit username

Enter your TradingView username at checkout / portal.

3) Access granted

You’re added to the invite-only script list.

4) Updates included

New builds roll out without re-buying (where applicable).

OI: Regime Map

Engine: CLM Regime Engine

Know the market mode in one glance: Contraction → Expansion → Trend.

A regime classifier that maps market behaviour into Contraction → Expansion → Trend so you can align expectations, risk, and tactics with the current phase.

- Regime shading: Contraction, Expansion, Trend

- Energy percentile plot for context & timing

- Optional Trend direction tint (Orderflow / Band mode)

- Trend entry “seed” markers on Trend regime entry

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

OI: AVMA Candles

Engine: AVMA + SAND + Bungee (Unified)

Clean candles + unified labels from multiple closed-source engines.

Candle colouring and unified buy/sell labels driven by three closed-source engines working together — built to keep charts clean while improving timing and context.

- Colours candles by AVMA side (clean trend context)

- Optional background regime tint from SAND

- Unified Buy/Sell labels (engine-confirmed signals)

- Toggle modules on/off to match your workflow

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

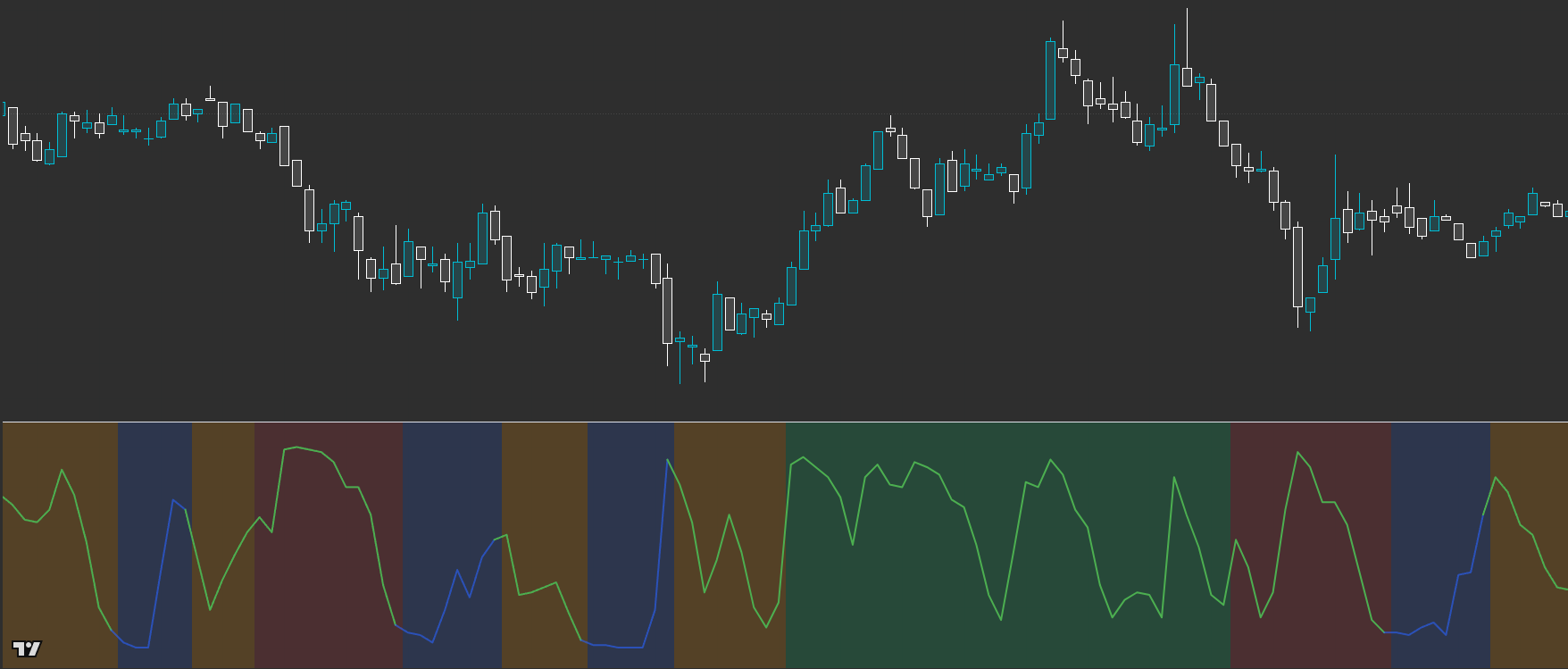

OI: Volume Alignment

Engine: Dual VDE (Track A + Track B) — Volume Participation Engine

See when volume agrees with price — spot chop, reversion, and sustainable trend early.

Volume Alignment visualises two closed-source participation tracks side-by-side so you can read whether volume is *supporting* the move or fading it. It’s a context tool (not a crossover system): the shape, slope, and position of both tracks tells you whether the market is trending, chopping, or setting up for mean reversion.

- Two-track volume participation view (Track A + Track B) for alignment reading

- Clear zones: Participation / Alert / Extreme to gauge intensity

- Trend-ST flip markers (optional) to contextualise regime turns

- Sync Pulse highlights when both tracks rise together from a low zone

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

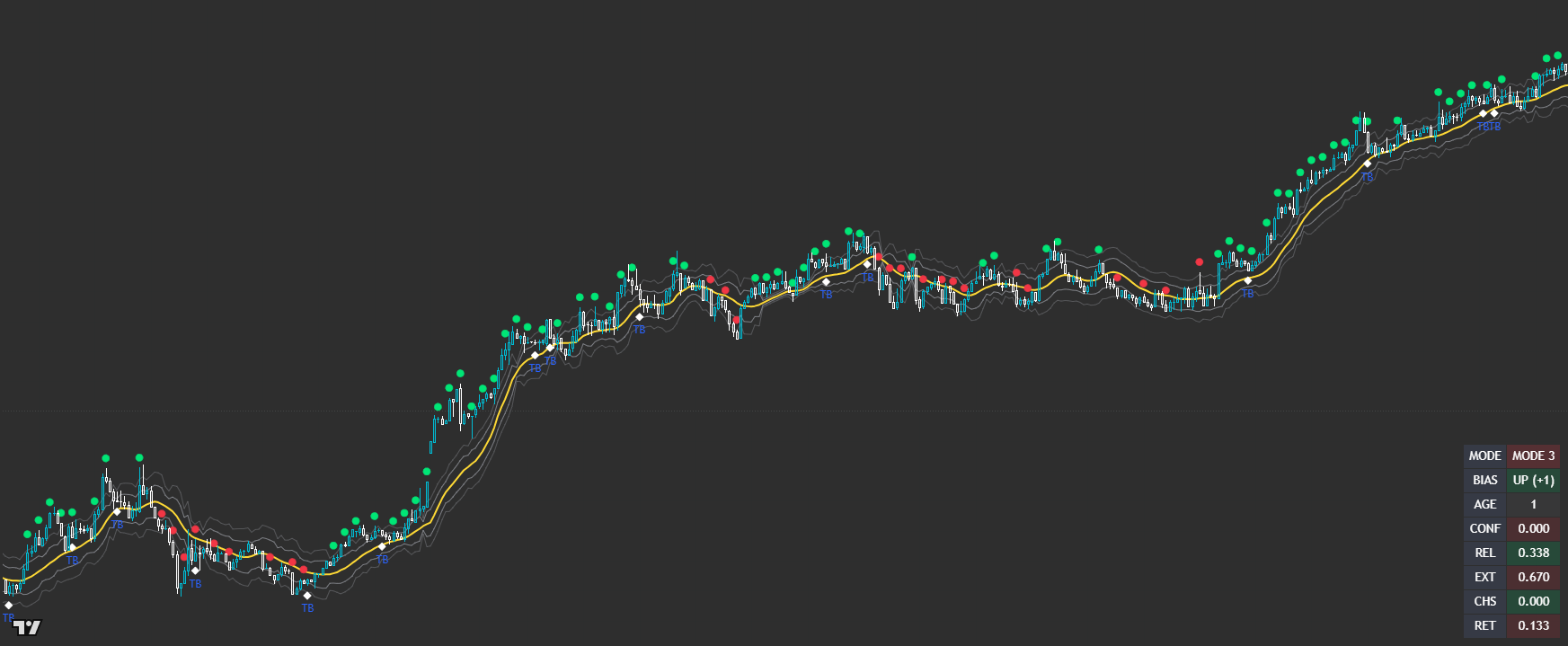

OI: Winners

Engine: Electric Line v2 (GridBias + PD + Parabolic Buffer)

Bias + structure + continuation windows, all in one clean layer.

A bias-and-structure engine that highlights the side with the advantage. The GridBias blend tracks pressure across timeframes, while the Parabolic Buffer shifts and tints the PD band when continuation conditions are active.

- GridBias line: LTF + HTF pressure blend

- Regime-aware weighting (VP structure + CLM + Dual VDE gating)

- Skewed PD bands + PB activation background

- Touch + slope-style entries (optional filters)

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

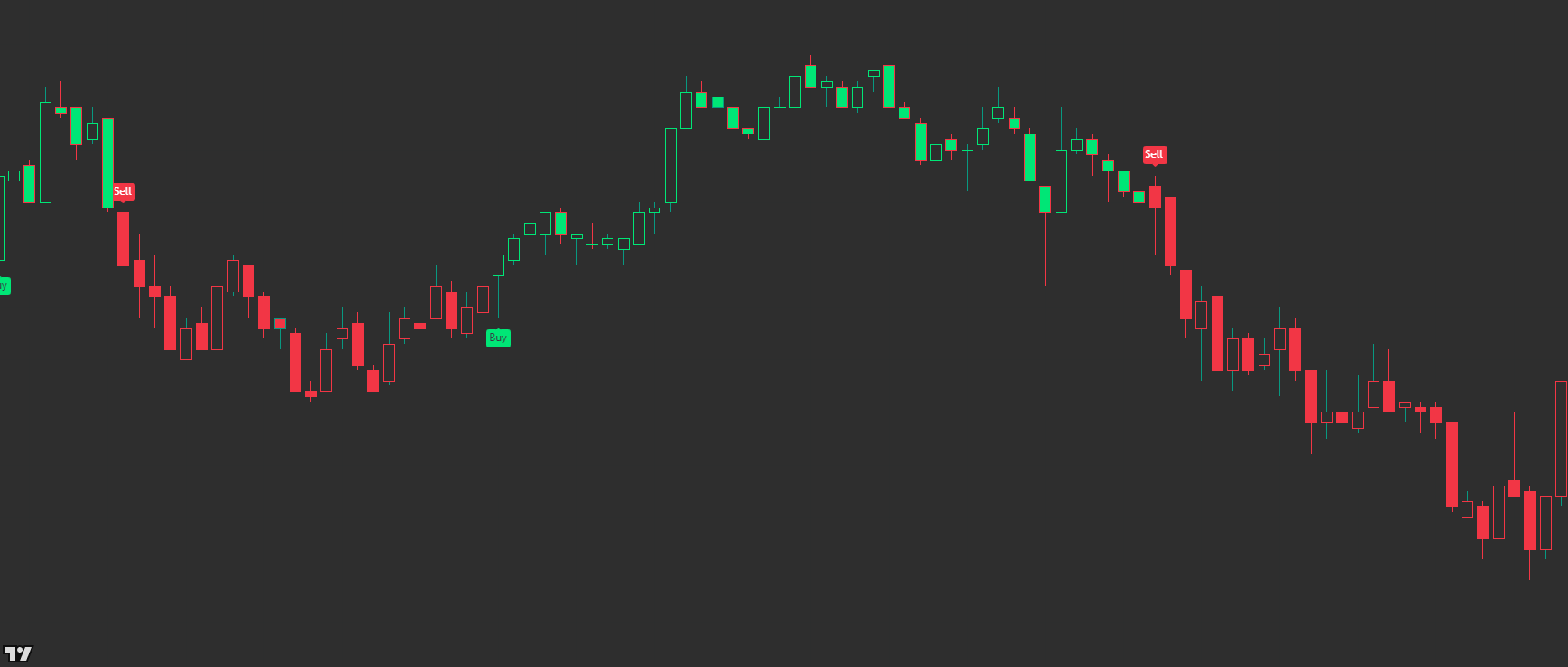

OI: Pulse

Engine: Flow Engine × Adaptive Buffer (Blend)

A clean buy/sell layer that adapts to regime — built to avoid noisy churn.

Pulse is an invite-only buy/sell indicator powered by proprietary, closed-source engines. It blends flow/participation context with an adaptive buffer to produce clear regime tinting and flip markers — designed to stay usable over time, without relying on public, copy-paste templates.

- Regime tint: Up / Down / Neutral so you can trade with the current state

- Flip markers highlight potential bias transitions (built-in spacing control)

- Optional direction-candle confirmation to reduce low-quality flips

- Neutral-zone behaviour designed to avoid constant switching in chop

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

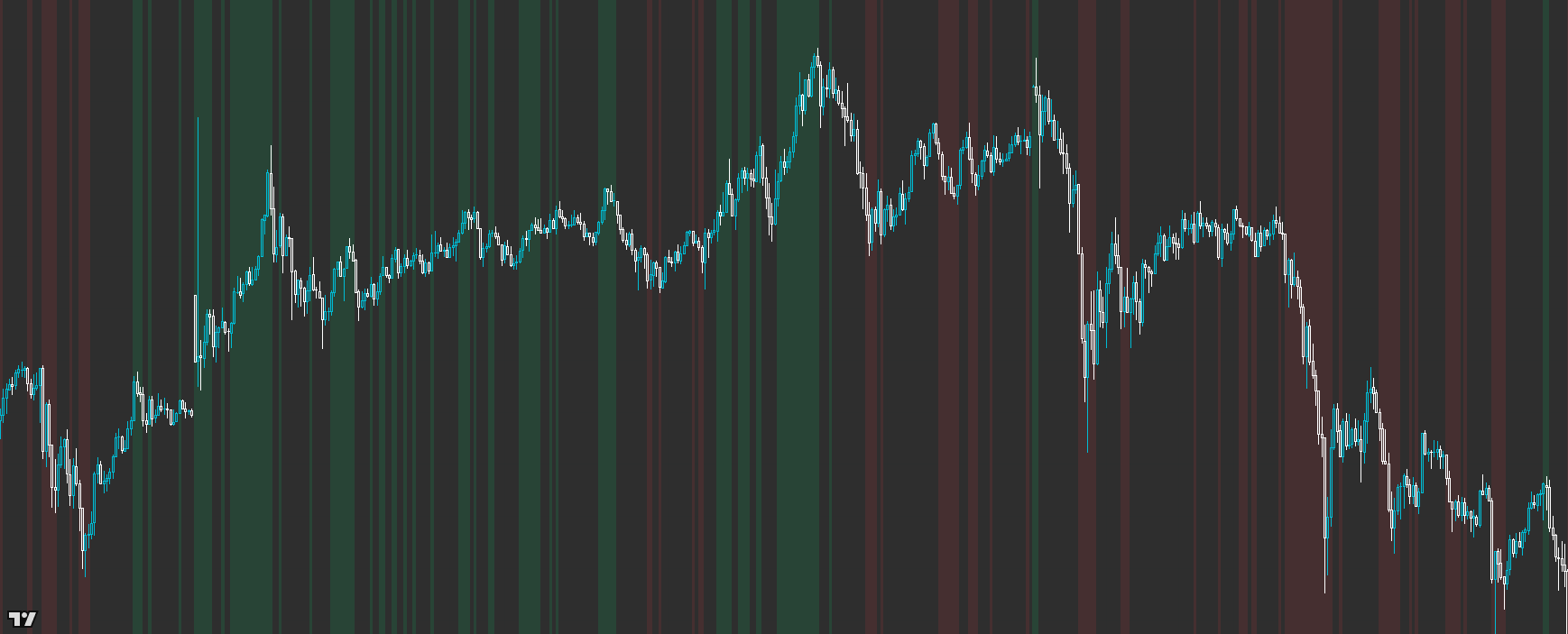

OI: Control

Engine: Closed-source Control Stack (CLM × VDE × SAND × PD)

Stay on the right side of the move — bias, guards, and pacing in one execution layer.

Control is your execution governor: a closed-source, multi-engine layer built to keep you aligned with the side driving the market. It blends multi-timeframe bias with regime/no-trade guards, session filters, and anti-chase pacing so you focus on higher-quality moments instead of reacting to noise.

- Multi-timeframe bias alignment (clean directional framework)

- Regime / no-trade guards to reduce low-quality participation

- Session + time filters to standardise your trading window

- Signal pacing + late-entry protection to avoid chasing

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

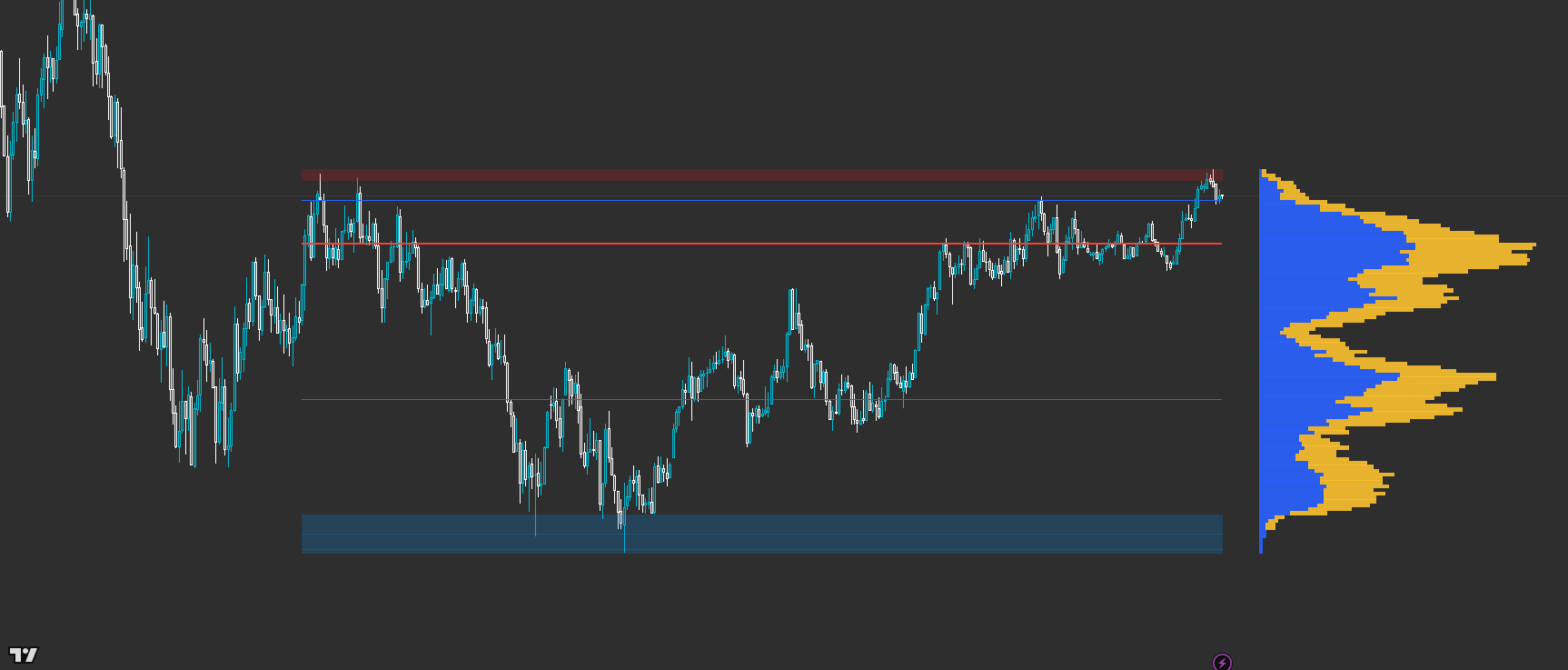

OI: Volume Profile

Engine: VP Core × CLM Context (Closed-source)

Auction structure in one glance — with flexible range + left/right anchoring for context and execution.

OI: Volume Profile is a flexible, trader-first VP built for real decisions: POC/VAH/VAL structure, thin-row mapping, and optional split (up/down) flow view. Set it to auto-follow your visible range or lock it to a fixed lookback — and anchor it left or right so you can run a wide ‘context VP’ on one side and a tighter ‘execution VP’ on the other.

- Range source: auto (Visible Range) or Fixed Bars lookback

- Anchor Left or Right with adjustable offset (layout-friendly)

- POC + Value Area levels (VAH/VAL) with clean line controls

- Split-profile view (Up/Down) for quick pressure read without clutter

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

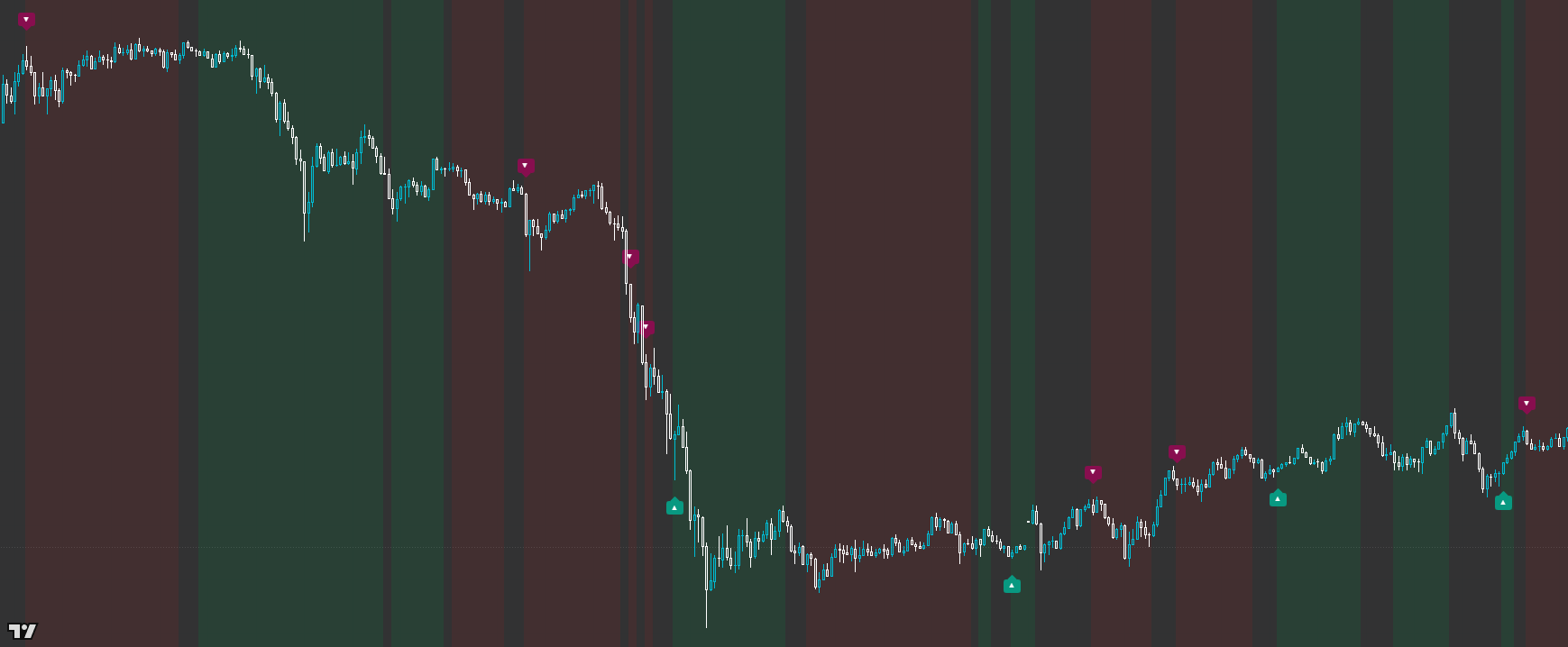

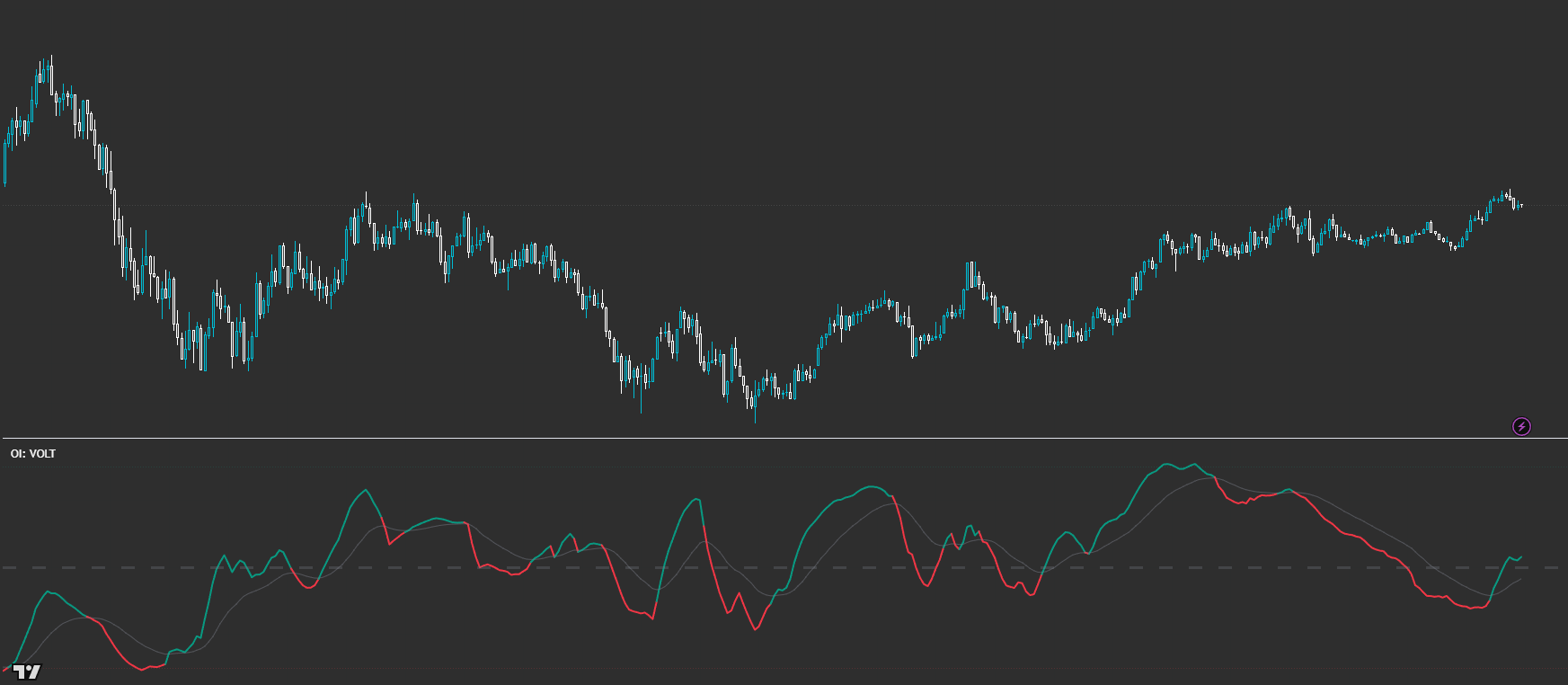

OI: VOLT

Engine: VOLT Bias Engine (CVD × CLM Dir × Dual VDE × VP Structure)

Directional context from pressure — read the bias, don’t trade the cross.

VOLT is a context oscillator built from multi-timeframe CVD pressure, liquidity/regime gating (CLM + Dual VDE), and structure weighting from Volume Profile. It’s designed to answer one question: ‘Which side has the advantage right now?’ The key is where the bias sits relative to the centre line and whether it’s strengthening or fading — not crossover hunting.

- Bias line on a stable -1 to +1 scale for clean context reads

- Multi-timeframe pressure blending (LTF + HTF CVD branches)

- Dual VDE regime gating (contraction / expansion / trend / correction context)

- CLM directional liquidity modulation + participation guard behaviour

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

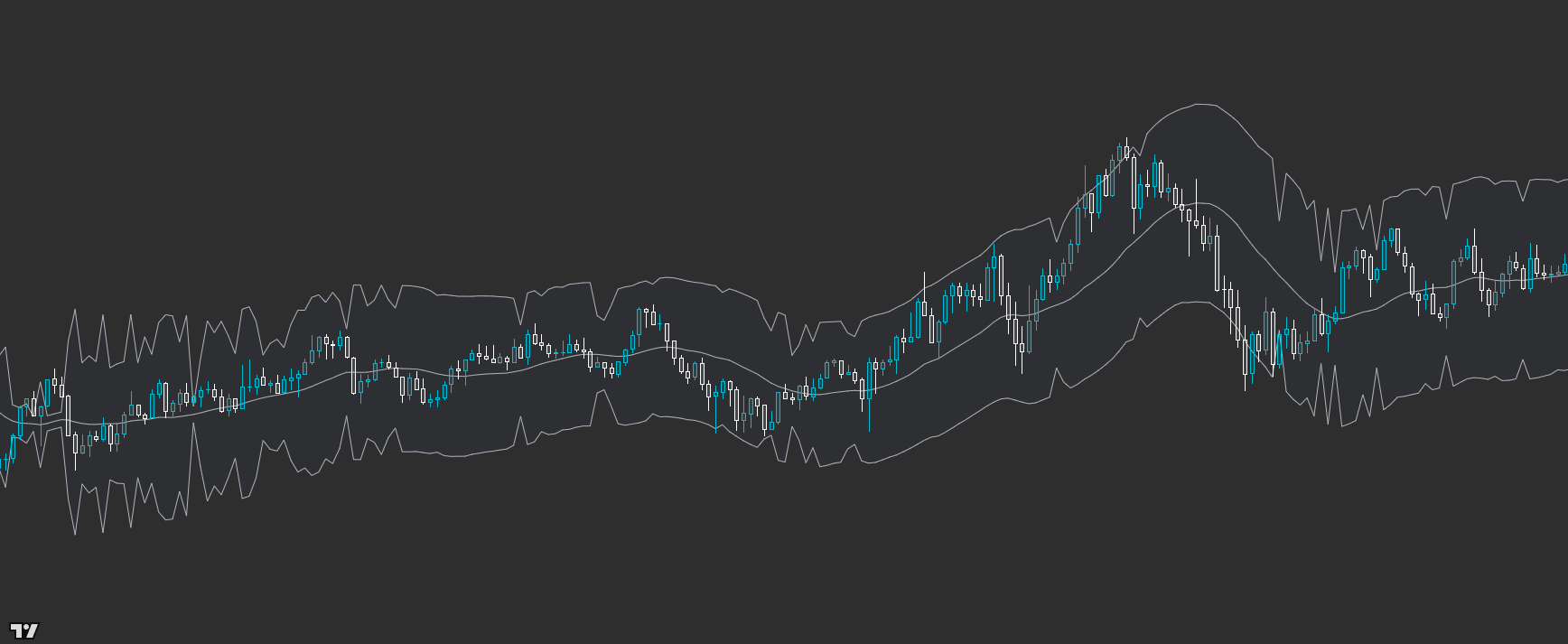

OI: Premium Discount Band

Engine: PD Engine — Value Axis + Adaptive Range

A deceptively simple band that upgrades your entries by forcing better prices.

Premium Discount Band helps you stop chasing and start entering at advantageous prices. Don’t be fooled by how simple it looks — there’s a lot going on under the hood to keep the zones relevant as conditions shift. The goal is straightforward: if you consistently enter at a better price, you improve your odds of profit even when you’re not perfectly right on direction. Use it as a context layer for execution — not as a magic signal.

- Clear premium/discount zones built around a dynamic value centerline

- Adaptive band width that responds to changing market conditions

- Helps improve expectancy by improving entry location (less chasing)

- Optional outer zones for extremes (when enabled)

Note: “Get Access” will later point to your paywall/checkout flow; keep it as-is for now.

Do you guarantee profits?

No. These are decision-support tools. Results depend on your execution, risk, and market conditions.

Are these “signal services”?

No. Most OI tools are designed as state/context layers with optional triggers — you still trade your plan.

Can I share access?

Access is tied to your TradingView username via invite-only scripts.