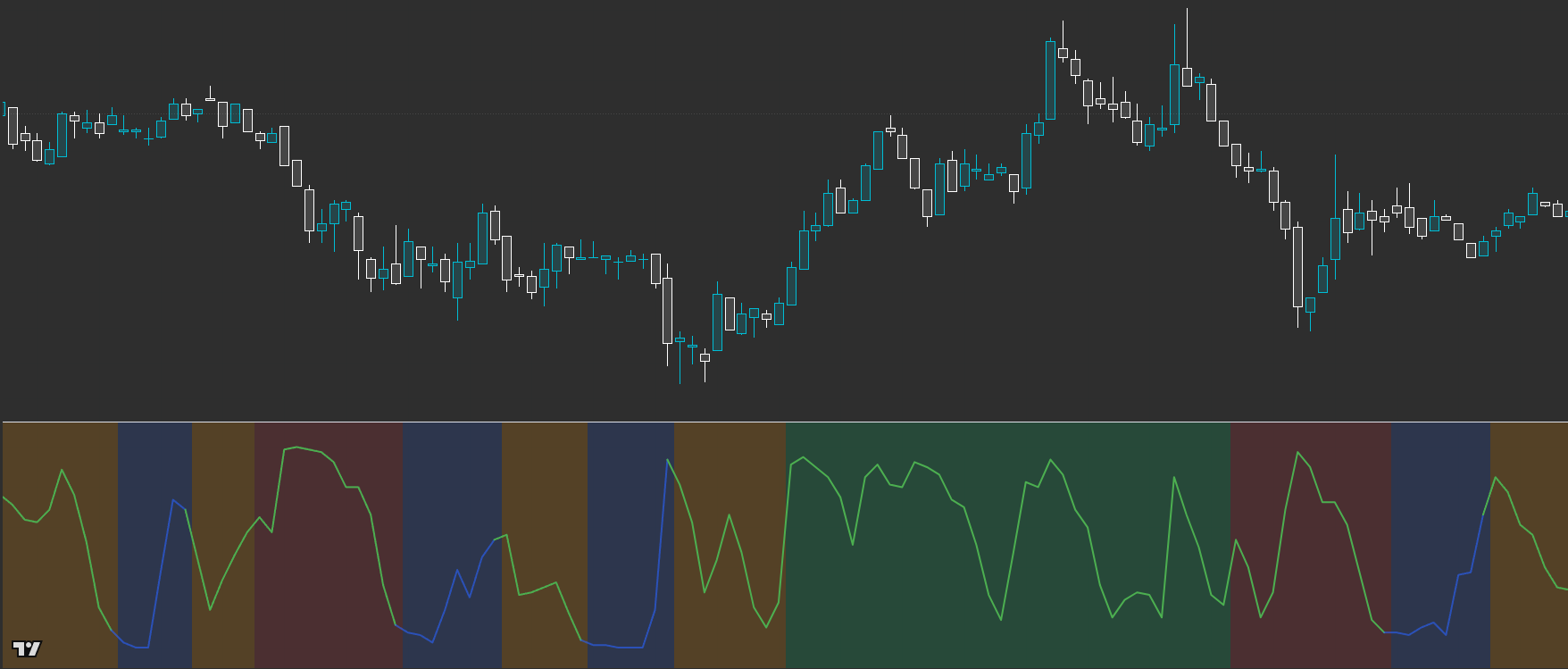

OI: Regime Map

Know the market mode in one glance: Contraction → Expansion → Trend. Powered by CLM Regime Engine.

A regime classifier that maps market behaviour into Contraction → Expansion → Trend so you can align expectations, risk, and tactics with the current phase.

Built for readable states and repeatable workflows — not indicator overload.

Designed to improve timing and decision quality while keeping the chart clean.

Sensible controls grouped logically — start with defaults, then tune for your market and session habits.

Access is managed via originalindicators.com — purchase, submit your TradingView username, and you’ll be added to the invite-only list.

Background regime shading (C / E / T)

Energy / pressure readout for timing and “readiness”

Optional trend tint + transition emphasis for breakout windows

Start each session by identifying the current regime.

In Contraction: plan levels and keep risk tight; be selective.

In Expansion: expect volatility; wait for clarity and avoid chasing.

In Trend: execute your trend model with more confidence and clearer invalidation.

Use it as a gate: only take setups that fit the current phase.

Best for

- Context filtering before you execute

- Reducing chop by matching tactics to phase

- Any asset / timeframe where regime shifts matter

Not ideal for

- “One-click signals” expectations (it’s a context layer)

- Dead sessions / low participation conditions (use your filters)

- Visuals (shading intensity / plots on/off) for clarity

- Trend direction source (if you prefer a specific style of tint)

- Participation / low-activity guard (if enabled in your build)

Avoid over-tuning early

Start with defaults, learn the states, then tune for your main market and session habits. The edge comes from consistent execution, not constant parameter chasing.

Is this a signal generator?

No — it’s a regime / context layer. It helps you choose the right playbook for the market phase.

Do I need other indicators?

No. It pairs well with other OI tools, but it also works alongside your existing execution model.

Does it work across markets?

Yes — it’s designed to be asset-agnostic. Best results come from applying consistent session/timeframe habits.

Works across assets and timeframes — best used as a decision layer alongside your execution model.

Get Access