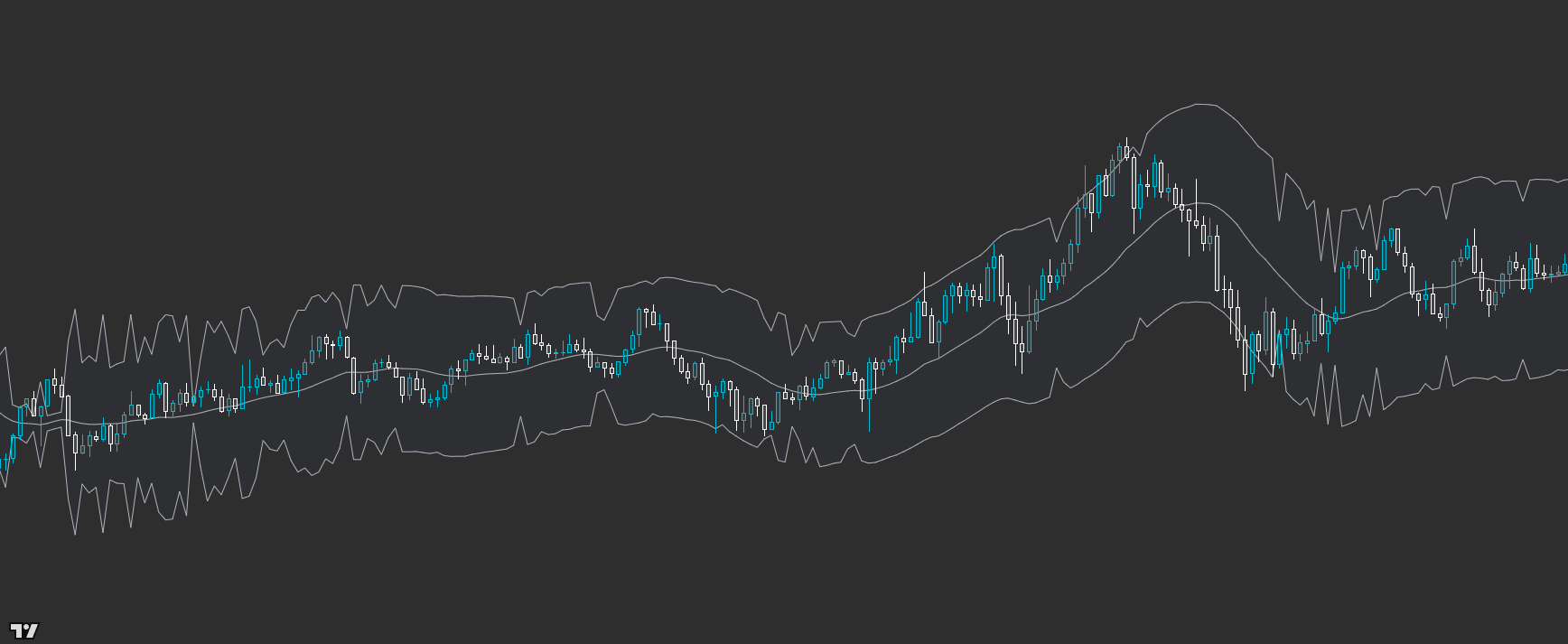

OI: Premium Discount Band

A deceptively simple band that upgrades your entries by forcing better prices. Powered by PD Engine — Value Axis + Adaptive Range.

Premium Discount Band helps you stop chasing and start entering at advantageous prices. Don’t be fooled by how simple it looks — there’s a lot going on under the hood to keep the zones relevant as conditions shift. The goal is straightforward: if you consistently enter at a better price, you improve your odds of profit even when you’re not perfectly right on direction. Use it as a context layer for execution — not as a magic signal.

Built for readable states and repeatable workflows — not indicator overload.

Designed to improve timing and decision quality while keeping the chart clean.

Sensible controls grouped logically — start with defaults, then tune for your market and session habits.

Access is managed via originalindicators.com — purchase, submit your TradingView username, and you’ll be added to the invite-only list.

A smoothed centerline (value axis) that the bands expand/contract around

Inner band zones for ‘fair’ premium/discount pricing

Optional outer zones for extremes when conditions stretch

A stable visual framework that stays readable across assets/timeframes

Decide direction using your normal bias/context tools first.

Use Discount zone for long ideas and Premium zone for short ideas (better location, less chase).

Treat touches/re-entries as *location*, then confirm with your execution model before triggering.

Best for

- Cleaner entries

- Reduced chasing

- Better risk placement

- Mean-reversion and pullback execution

Not ideal for

- Trading it as a standalone ‘buy/sell’ system

- Blindly fading strong trend without context

- Calc timeframe (if you want a steadier or faster band)

- Range model + range length (how reactive the bands feel)

- Inner vs outer zones (keep it simple at first)

Avoid over-tuning early

Start with defaults, learn the states, then tune for your main market and session habits. The edge comes from consistent execution, not constant parameter chasing.

Is this just a Bollinger Band?

No. It may look simple, but it’s not a basic volatility wrapper. It’s a pricing framework built around a dynamic value axis with adaptive behaviour under the hood.

Can I trade it as a crossover strategy?

You shouldn’t. This is an entry-location and pricing tool — direction comes from your bias/context, then the band helps you execute at better prices.

Works across assets and timeframes — best used as a decision layer alongside your execution model.

Get Access